FAQ

In any business transaction it is important to make sure that the tax invoice received is valid and complies with all legal requirements. At first glance this may seem like a complicated task, but nowadays modern technology provides us with an easy and quick way to check the validity of an invoice.

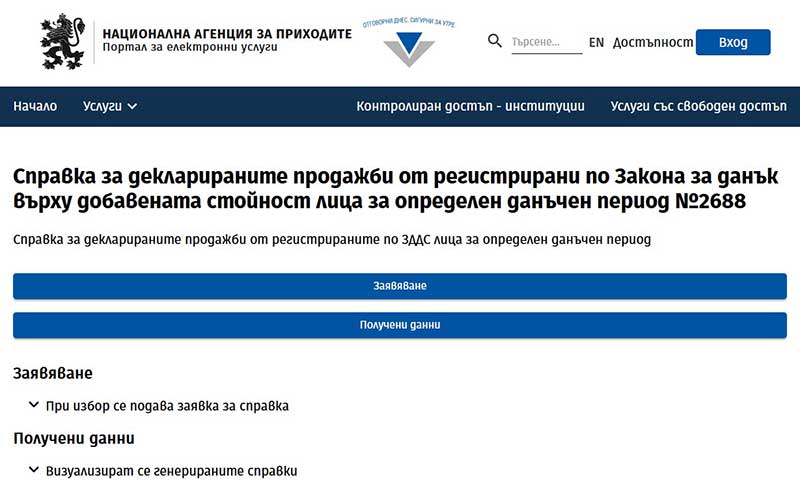

In the portal of the National Revenue Agency (NRA), an electronic service has been created to help taxable persons check for themselves what invoices have been issued in their name by other taxable persons registered under the VAT Act.

To check what invoices have been issued in your name, you need to log in to the NRA portal and select the service "Reference of declared sales by persons registered under the VAT Act for a certain tax period".

Click on the "Request" button to request a statement of sales declared by VAT registered persons for a specific tax period. The system will ask you to log in to your account if you have not already done so. You can log in using a qualified electronic signature (QES), personal identification code (PIC) or E-authentication. Once you are logged in, you can proceed with the request.

Now you have to select the period covered by the reference, here it is important to specify that:

It is also important to clarify that in order to get correct results in a return, it must be past the deadline for filing VAT returns for the period of the return. Simply put, the results in a return may not be correct if it is made earlier than the 15th of the following month!

Once you submit the request, you will receive an email stating the request has been accepted and completed, also a link to the generated return. The report contains the following information: name of the contractor, UIC, invoice number and date, taxable supply tax base, VAT charged and exempt supply tax base.

This way you can always check and find out whether an invoice is valid, accounted for and complies with all legal requirements.